Friday, December 28, 2007

Natural Gas Inventory Report 12-28-07

Thursday, December 20, 2007

Natural Gas Inventory Report 12-20-07

Thursday, December 13, 2007

Natural Gas Inventory Report 12-13-07

Thursday, December 06, 2007

Natural Gas Inventory Report 12-06-07

Thursday, November 29, 2007

Natural Gas Inventory Report 11-29-07

Wednesday, November 21, 2007

Natural Gas Inventory Report 11-21-07

Thursday, November 15, 2007

Natural Gas Inventory Report 11-15-07

Sunday, November 11, 2007

Thursday, November 08, 2007

Natural Gas Inventory Report 11-08-07

Thursday, November 01, 2007

Natural Gas Inventory Report 11-01-07

Thursday, October 25, 2007

Natural Gas Inventory Report 10-25-07

Thursday, October 18, 2007

Natural Gas Inventory Report 10-18-07

Tuesday, October 16, 2007

Monday, October 15, 2007

Sunday, October 14, 2007

Thursday, October 11, 2007

Natural Gas Inventory Report 10-11-07

Saturday, October 06, 2007

Thursday, October 04, 2007

Natural Gas Inventory Report 10-04-07

Thursday, September 27, 2007

Natural Gas Inventory Report 9-27-07

Thursday, September 20, 2007

Natural Gas Inventory Report 9-27-07

Sunday, September 16, 2007

Thursday, September 13, 2007

Natural Gas Inventory Report 9-13-07

Tuesday, September 11, 2007

Thursday, September 06, 2007

Natural Gas Inventory Report 9-06-07

Thursday, August 30, 2007

Natural Gas Inventory Report 8-30-07

Sunday, August 26, 2007

Thursday, August 23, 2007

Natural Gas Inventories......Week Ending August 17, 2007

Monday, August 20, 2007

Thursday, August 16, 2007

Natural Gas Inventory Report 8-16-07

EIA Natural Gas Storage Data

Lower 48 (08/10/07): 2,903 Bcf

Lower 48 (08/03/07): 2,882 Bcf

Implied net change: 21 Bcf

Year ago stocks: 2,795 Bcf

5-year avg stocks: 2,532

% dif to 5-yr avg: 14.7 %

Tuesday, August 14, 2007

Thursday, August 09, 2007

Natural Gas Inventory Report 8-09-07

Sunday, August 05, 2007

Thursday, August 02, 2007

ADVFN is an excellent resource for natural gas quotes, news, and analysis.....100% free.

Thursday, July 26, 2007

Natural Gas Inventory Report 7-26-07

Tuesday, July 24, 2007

Natural gas prices are currently at a 10 month low.

Buy Stocks Online for $0. Trade stocks for free on Zecco.com. The Free Trading Community. www.zecco.com

Thursday, July 19, 2007

Natural Gas Inventory Report 7-19-07

ADVFN is an excellent resource for natural gas quotes, news, and analysis.....100% free.

Thursday, July 12, 2007

Natural Gas Inventory Report 7-12-07

Friday, July 06, 2007

Monday, July 02, 2007

Thursday, June 28, 2007

Natural Gas Inventory Report 6-28-07

Sunday, June 24, 2007

Thursday, June 21, 2007

Natural Gas Inventory Report 6-21-07

Saturday, June 16, 2007

Gazprom Raises Natural Gas Production Estimates

"If the market situation is positive or very positive, we could reach this production level," said Alexander Ananenkov, Gazprom deputy board chairman.

Ananenkov said total natural gas output in 2010 is planned at a maximum of 560 billion cubic meters, but could be increased to 570 billion cubic meters if needed, Novosti reported Thursday.

Gazprom estimates the value of the company's hydrocarbon reserves at $182.5 billion, not including oil subsidiary Gazprom Neft, whose reserves are worth $24 billion.

Thursday, June 14, 2007

Natural Gas Inventory Report 6-14-07

Thursday, June 07, 2007

Thursday, May 31, 2007

Monday, May 28, 2007

A total of 3.8 trillion cubic metres (133 trillion cubic feet) of natural gas deposits have been found in the western part of the Sichuan Basin, the China Daily said, citing officials in Dazhou city, near the reserve.

The discovery is equivalent to about 60 years of China's total production at current output levels.

The deposits include proven exploitable reserves of a newly-discovered 244 billion cubic metres of gas alongside the 356 billion cubic metres in Puguang gas field, which was announced in March, the report said.

It has become the largest gas field in the country, topping the Sulige gas field in north China's Inner Mongolia Region discovered last year with exploitable reserves of 533.6 billion cubic metres, the newspaper said.

China plans to boost its annual natural gas output from 49.3 billion cubic metres in 2005 to 92 billion cubic metres by 2010, as consumption is expected to more than double the 2005 figure to top 100 billion cubic metres by 2010.

The government has strengthened exploration efforts in a bid to feed the country's brisk economic expansion that has seen double-digit growth for four consecutive years.

Last week, a large gas field with reserves of nearly 30 billion cubic metres was discovered in Karamay in the Xinjiang region in the northwest.

A major oil field, the Jidong Nanpu oil field in Bohai Bay in the north, has also been announced recently.

The oil field is the largest discovery in the country in more than four decades, with expected reserves reaching one billion tonnes or about 7.35 billion barrels.

Thursday, May 24, 2007

Thursday, May 17, 2007

Thursday, May 10, 2007

Thursday, May 03, 2007

Thursday, April 26, 2007

Thursday, April 19, 2007

Wednesday, April 18, 2007

Natural Gas ETF

The fund expects its price to reflect the daily percentage change in the price of natural gas delivered at Henry Hub, La. The fund has an expense ratio of 0.6%.

"UNG intends to invest primarily in those futures contracts that are in the two months closest to expiration because we feel those contracts will permit the fund to best achieve its investment objective," said John Hyland, the fund's portfolio manager in a written statement. He added that the partnership "does not seek to use leverage in the portfolio to achieve its investment goals."

Thursday, April 12, 2007

Thursday, April 05, 2007

Tuesday, April 03, 2007

Production has begun at a rate of 18 million cubic feet of gas per day from three wells. Pioneer holds a 100 percent working interest and a 75 percent stake in net revenue from the field, assuming a 25 percent royalty to the government.

"This new play is expected to deliver strong returns and make a significant contribution to Pioneer's projected 2007 production growth in Canada of 30 percent to 35 percent," said Chairman and Chief Executive Scott Sheffield in a statement

Field operations, which are limited to the winter season, currently have capacity for 24 million cubic feet of gas per day, although that may be expanded up to 40 million cubic feet daily, Pioneer said.

The company holds about 375,000 acres in the field area with an average working interest of 98 percent. Pioneer said it has located six other potential prospects on the land; two have tested for gas and are awaiting development.

Thursday, March 29, 2007

Monday, March 26, 2007

The Nejo natural gas block was awarded to a consortium formed by Spain's Cobra and Mexico's Monclova Pirineos Gas, while the Monclova block was won by Construcciones Mecanicas Monclova and Administradora de Proyectos de Campos, of Mexico, along with Colombia's Production Testing Services, Pemex said in a news release Sunday.

A third block, Euro, received no bids, and will be reevaluated, the company said.

Pemex said the two natural gas contracts will involve investment of at least US$177 million in the next three years. The contracts are for up to 15 years, with investment up to US$1.35 billion

Thursday, March 22, 2007

Thursday, March 15, 2007

Thursday, March 08, 2007

Wednesday, March 07, 2007

The natural gas distributor's quarterly earnings fell to $70.7 million from $72 million in the prior-year period. Per-share profit was flat at 94 cents, as the number of outstanding shares declined over the year-earlier period.

Wall Street, on average, expected quarterly earnings of 98 cents per share, according to an analyst poll by Thomson Financial.

Operating revenue dropped to $677.2 million from $921.3 million, as this year's first quarter was 15 percent warmer than normal and 6 percent warmer than the prior year. The reduced demand offset Piedmont Natural Gas' growing customer rolls and reduced operations and maintenance expenses.

Piedmont Natural Gas shares fell 21 cents to $24.93 in morning trading on the New York Stock Exchange.

Saturday, March 03, 2007

Chavez said on his radio talk show late Thursday that he had spoken to Argentine President Nestor Kirchner about the idea of forming "a kind of Organization of Gas Exporting and Producing Countries in South America." He proposed naming it Opegas Sur, and said it would start with Venezuela, Bolivia and Argentina, but could be expanded.

Far-fetched and toothless is how some natural gas experts described the idea Friday. One reason is that none of the three countries exports natural gas outside of South America, which stymies their ability to influence world gas markets. Venezuela doesn't export any gas at all.

"I'm not really sure what would be the objective," said Anouk Honore, a natural gas analyst at the London-based Oxford Institute for Energy Studies. It might make more sense if the proposed cartel were to include Trinidad, a major gas exporter, she suggested.

"It would have zero impact," declared Bolivian petroleum analyst Andres Stepkowski.

He noted that the Organization of the Petroleum Exporting Countries influences oil prices because crude is sold on a spot market — that is, sold for cash and delivered immediately — so any output cuts are felt immediately.

Natural gas, however, is sold through long-term contracts, and suppliers and buyers use a formula to adjust the price every three or six months.

A natural gas cartel might work against Chavez's integrationist goals because it would mostly hurt South American consumers.

Thursday, March 01, 2007

Thursday, February 22, 2007

Tuesday, February 20, 2007

Northamerican Energy Group Corporation has developed a proven growth strategy of identification, acquisition, and development of domestic hydrocarbon reserves. The Company concentrates on identifying prospects that, for the most part, have proven oil and gas production and have been operating for many years. By acquiring working interests in proven, low-risk fields, the Company eliminates the risk of drilling dry-holes and avoids the expense of building major infrastructure to get the product to market. The Company's low-cost operations and low overhead structure allows it to maximize income and revenue.

The Company confirmed that this step not only begins its program to put back into production natural gas operations on its existing oil and gas wells, but also the gas wells that are part of its 17 lease package that Northamerican disclosed on November 8th and December 26th 2006.

Thursday, February 15, 2007

Wednesday, February 14, 2007

BioEnergy Solutions is offering a cost-free alternative to the capital costs farmers and other food processors face in coming years to meet new state air quality and greenhouse gas standards. The company designs, builds and maintains the waste-to-gas system on the farm or at the processing facility, then sells the natural gas to power generators. The property owners also enjoy a new source of revenue, sharing in the sales of biogas and carbon credits.

"BioEnergy Solutions was founded by dairymen, and we understand the challenges agriculture faces in the coming years to reduce emissions," said company President DavidAlbers, a third-generation dairyman. "PG&E has a similar challenge, which is to increase its production of renewable energy. This agreement turns what would otherwise be a growing problem for farmers into a new revenue source and helps PG&E reach the environmental goals set by the company and the state."

"Developing new sources of renewable energy is a priority for PG&E," said Fong Wan, PG&E's vice president of energy procurement. "This project is yet another example of our company's commitment to the environment by delivering clean, climate-friendly energy to our customers."

Monday, February 12, 2007

On Friday, prices climbed briefly above the psychological $60 barrier on unrelenting cold U.S. weather.

But light, sweet crude for March delivery was down 84 cents to $59.05 a barrel in electronic trading on the New York Mercantile Exchange by afternoon in Europe. Brent crude for March dropped $1.13 to $57.88 a barrel at London's ICE Futures exchange.

The biggest market driver in recent weeks has been the weather, which has depleted U.S. supplies of distillate fuels, which include heating oil, by the largest amount since December 2005. With temperatures still below normal across the Northeast United States, which consumes 80 percent of the nation's heating oil, traders are bracing for the U.S. government inventory data on Wednesday to show an even bigger decrease.

Heating oil was down 3.26 cents to $1.6925 a gallon on the Nymex, and natural gas fell 40.7 cents to $7.420 per 1,000 cubic feet.

Natural gas, the more popular form of home heating in the United States, had risen more than 60 percent over the past month on the recent cold weather.

Thursday, February 08, 2007

Wednesday, February 07, 2007

Under an agreement announced by federal prosecutors and the FBI, El Paso Corp. will forfeit $5.48 million (€4.23 million) to the United States, which will seek to transfer the money to the Development Fund of Iraq to be paid as restitution for the benefit of the people of Iraq.

In a separate deal with the Securities and Exchange Commission, the Houston-based El Paso agreed to pay an additional $2.25 million (€1.74 million).

In a statement, U.S. Attorney Michael Garcia said the $5.48 million (€4.23 million) represented the amount of illegal surcharges paid to Saddam Hussein's government by third parties from whom El Paso purchased Iraqi oil from approximately mid-2000 until about March 2003.

In return for the settlements, El Paso will not be prosecuted for any crimes except possibly criminal tax violations as long as it continues to continue cooperating fully with the federal government in its investigation into the scandal-ridden U.N. program, Garcia said.

Tuesday, February 06, 2007

Iran proposed to Russia in late January establishing "a cooperation organization in the gas sector similar to OPEC." The Russian president said the idea was worth considering, a response some experts said was calculated to influence Europe's attitude to Russian energy supplies.

"Iran has proposed to Russia setting up a gas equivalent of OPEC," said Mikhail Margelov, head of the Federation Council's international affairs committee. "But my prediction is that we are unlikely to become a member of a gas OPEC."

"By not joining a [gas] OPEC we would preserve our freedom of action. Russia needs to be able to maneuver freely on the global natural gas market," Margelov said.

Margelov's opinion reflects the position of some Russian experts and officials, who have called the proposal political, and argued that regulating gas production and fixing the price would be difficult, as gas supplies are largely regulated by long-term contracts at present.

President Vladimir Putin welcomed the idea at an annual news conference with the Russian and foreign media at the beginning of the month, saying that such an organization could coordinate policies in the gas sphere to ensure uninterrupted supplies, but should not fix prices like the Organization of Petroleum Exporting Countries.

"A 'gas OPEC' is an interesting idea. We will think about it," Putin said.

"At the first stage, we agree with Iranian experts, partners and some other countries that produce and supply hydrocarbons to world markets in large volumes. We are already trying to coordinate our actions to develop markets and intend to do so in the future," the president said.

Russia's image as a reliable energy supplier has been marred in the last two years over pricing rows with Ukraine and Belarus, which resulted in a brief disruption of gas and oil exports to the European Union. Moscow has also clashed with the EU over its reluctance to sign an energy charter giving access to its export pipelines.

Margelov said gas would be central on the agenda of President Putin's tour of Persian Gulf countries, including major energy producers Saudi Arabia and Qatar, in mid-February.

Russia and Saudi Arabia are in talks on the Mideast nation's initiative to develop its gas sector with Russia's assistance. The total value of the projects was estimated at $20-25 billion.

Contacts between Qatar, which has the world's third-largest gas reserves of 11.2 trillion cubic meters, and Russia's Gazprom, the world's largest gas producer, have intensified during the last few years of Putin's presidency.

Monday, February 05, 2007

Light, sweet crude for March delivery rose 10 cents to $59.10 a barrel in early afternoon trading on the New York Mercantile Exchange. Brent crude for March delivery on the ICE Futures exchange inched up 2 cents to $58.43 a barrel.

Natural gas futures gained nearly 17 cents to $7.644 per 1,000 cubic feet.

"The weather is what's the most urgent, short-term issue here," said Tim Evans, an energy analyst at Citigroup Global Markets. "Over the weekend, the weather forecast became a lot colder for the six to 10 day period as well as the 11 to 15 day period."

Colder-than-normal temperatures blanketed the Northeast and Midwest on Monday and were expected to linger through Feb. 18, according to the National Weather Service. On Monday, temperatures registered in the single-digits and teens from Maryland to Maine, while many states in the Midwest were experiencing below zero temperatures with dangerous wind chills.

The Northeast accounts for 80 percent of U.S. heating oil consumption, while the Midwest is the bulk of the natural gas market. Heating oil futures rose half a cent to $1.6890 a gallon.

Oil prices had fallen as low as $49.90 a barrel last month after an unseasonably warm January.

Monday's gain in oil prices comes after Friday's rally that saw prices rise $1.72 to settle at $59.02 a barrel on winter weather concerns and supply worries driven by a second round of OPEC production cuts. That was the highest close since it finished at $61.05 on the last trading day of 2006.

Thursday, February 01, 2007

Monday, January 29, 2007

Friday, January 26, 2007

The pact, which initially covers a period of one year, includes an assessment of Venezuela's natural gas industry and the development of a plan to improve its efficiency.

Venezuela hopes to consolidate its system to transport and distribute natural gas with the agreement, PDVSA said in a statement.

Felix Rodriguez, president of PDVSA GAS, said his company hopes to incorporate the experience of Russian state company GAZPROM through a project that "will allow us to increase production and improve our ability to respond to contingencies."

Venezuela has 147.5 billion cubic feet of proven natural gas reserves, according to official estimates. This would give it the eighth largest reserves in the world and the largest in Latin America.

Thursday, January 25, 2007

Wednesday, January 24, 2007

Gas from the Shah Deniz field – one of Azerbaijan's largest – has been keenly awaited by both Azerbaijan and neighboring Georgia, both of which have been affected by Russia's decision to increase prices sharply last year.

The operators had already stopped output at the field a week after starting commercial production in December, and only brought it back onstream a month later on Jan. 14.

The decision to cease production again was taken after checks on the effectiveness of that maintenance work, said a spokeswoman for BP's Azerbaijani subsidiary, Tamam Bayatli.

The Dec. 15 halt in production forced Georgia to sign stopgap gas supply deals with Moscow at what it considers to be extortionate prices.

The BP-led consortium, which also includes Norway's Statoil, France's Total, Russia's Lukoil and other companies, has said it plans to produce at least 5.4 billion cubic meters of gas from Shah Deniz this year, with about 2.4 billion cubic meters earmarked for domestic consumption, 2.8 billion cubic meters for export to Turkey, and 270 million cubic meters for export to Georgia.

Tuesday, January 23, 2007

Texas Gas, which is headquartered in Owensboro, Kentucky, has begun the filing process with the Federal Energy Regulatory Commission.

The commission will be the lead federal agency for conducting an environmental review of the project.

The company expects the line will cost about 360 (m) million dollars.

With regulatory approval, Texas Gas plans to begin construction in 2008 and complete the project in early 2009.

The line would carry gas from the Fayetteville Shale, an underground reservoir of natural gas that was first plumbed by Houston-based Southwestern Energy Company in 2004.

Monday, January 22, 2007

'Qatari gas will come to Oman by 2008,' Mohammad Al Rumhy said in Muscat.

'They will supply around 200 million cubic feet a day.'

The gas will flow through the Dolphin pipeline, the first cross-border gas line in the region.

Dolphin Energy aims to take up to 3.5 billion cubic feet a day of natural gas to the UAE and then later to Oman.

Doubts about the $3.5 billion project surfaced last July when Saudi Arabia told minority partners in the project, Total and Occidental Petroleum, it had reservations about the pipeline route.

Dolphin said then it had not received any objection from Saudi Arabia and in August it completed the sub-sea line.

The line is scheduled to begin supplying the UAE in 2007.

At present, Oman supplies up to 135 million cubic feet of gas per day to the UAE. But the flow will change direction in 2008 when Oman's gas consumption rises as new gas-consuming industries start.

Oman will boost gas output this year to 60 million cubic metres (2.119 billion cu ft) per day from 50 million cu m/d in the previous year through redevelopment of existing fields, Rumhy said.

Abu Dhabi's state-run Mubadala group owns 51 per cent of Dolphin, while France's Total and US Occidental Petroleum each hold a 24.5 per cent stake.

Friday, January 19, 2007

With an explosively intensifying low-pressure system heading into the Canadian Maritimes, northwest winds are becoming strong and gusty across the Mid-Atlantic and Northeast. The winds will continue across the region Saturday and across New England a final day on Sunday. On Saturday, gusts will be in the 40-to-50-mph range over eastern New York and the 40-to-60-mph range across New England. Some tree damage and power outages are possible.

On Saturday, heavy lake-effect snow will continue for northwest Pennsylvania and parts of Upstate New York with snow totals locally in the 1-to-2-foot range by evening.

By Sunday, the lake effect snow will decrease, but a new winter storm will move into the southern Great Lakes and Ohio Valley. This system will spread a light wintry mix into the southern Mid-Atlantic.

On Monday, rain will douse southeast Virginia while flurries linger from the Appalachians westward.

A developing winter storm is quickly impacting parts of Texas with snow for the far west-central counties and the panhandle, sleet and freezing rain from the Davis Mountains to Lubbock to Childress and rain over the remainder of the state.

As the storm evolves Saturday, heavy snow and sleet will accumulate over 6 inches in parts of far west Texas and western Oklahoma. Sleet and freezing rain will extend from parts of western Texas northward across a diagonal slice of Oklahoma from the southwest to northeast corners including Oklahoma City and Tulsa. Also wintry mix will develop over northern Arkansas.

Steady locally inch-plus rain will develop through central and east Texas and southeast Oklahoma, moving across the Lower Mississippi River Valley into Saturday night.

On Sunday, the storm will rapidly shift eastward with rain moving through the Tennessee Valley and northern Gulf Coast States. By Sunday night and early Monday as the rain enters the Southeast, the western Carolinas could see some sleet and freezing rain.

On Monday, a corridor of heavy inch-plus rain may stall for a time from the eastern Carolinas to southern Louisiana. A new storm in the Southwest will bring a burst of accumulating snow to southwest Texas.

Thursday, January 18, 2007

Details of the proposed Dodds-Roundhill Coal Gasification Project were released in a public disclosure document on the company's website. The application will be submitted for regulatory approval in 2008.

Sherritt, a Toronto-based natural resource company, plans to build a surface coal mine and gasification facility to process coal and produce the gas about 80 kilometres southeast of Edmonton. The project will be managed and operated by Sherritt. The coal feedstock is owned by the Carbon Development Partnership, which is an equally divided partnership between Sherritt and the OTPP.

''The Dodds-Roundhill coal gasification project represents a key step towards Alberta's future as a global centre of excellence in innovative 'clean coal' technology,'' Barry Hatt, senior vice-president of Sherritt, said in the report.

''This new technology will help preserve natural gas resources for higher value uses and unlock the full energy potential of coal. This new energy source can support the development of Alberta's vast oilsands resources in an environmentally sustainable manner,'' he said.

Following regulatory approval, which the company expects in 2009, construction would begin mid-2009 and the start up of the plant would be 2011, the company said.

The proposed mine and plant are the first stage of the project. The company's long-term plans involve as many as four similar facilities.

Wednesday, January 17, 2007

The Polish company, Polskie Gornictwo Naftowe & Gazownictwo, or PGNiG, did not specify what, if any, effect the dispute involving the Yamal pipeline, which carries Russian gas to Europe, might have.

The dispute comes as Russia, under President Vladimir Putin, has been putting pressure on other European countries regarding energy resources. Most recently, Gazprom suspended natural gas supplies to Belarus after a dispute over fees. That was resolved Dec. 31 with a new deal on prices, barely avoiding a cutoff to Europe. But Putin said Tuesday that Russia would cut energy subsidies to Belarus.

Gazprom and Rosneft, both state- controlled Russian companies, have also been jockeying for rights to buy out the Russian partners of the British oil company BP. The move might eventually leave BP with a minority stake in the venture; it now owns half.

And in December, Gazprom took majority control of the largest combined oil and natural gas field in the world, Sakhalin-2, when the foreign developers, led by Royal Dutch Shell, agreed to sell 50 percent plus one share to Gazprom. That came after months of pressure on the company and accusations from a Russian environmental regulator. Critics called the sale of the Russian Far East field a forced nationalization.

Tuesday, January 16, 2007

Chevron Corp. and Royal Dutch Shell Plc are delaying construction projects from Australia to Nigeria, and that may raise natural gas prices for years to come.

None of the world's biggest energy companies approved developments last year to increase production of liquefied natural gas, which helps heat homes and run power plants from Tokyo to Boston. The main reason is the cost to build LNG plants has tripled in six years, according to Bechtel Group Inc., the biggest U.S. contractor.

Natural gas prices are three times higher than during the 1990s and consumption of the fuel will outpace the 1.6 percent annual gain in energy demand for the next 25 years, according to the International Energy Agency. Gas is also becoming more popular because it emits 29 percent less carbon dioxide than oil and 45 percent less than coal burned in power stations.

"Costs are going up and they're going up far faster than anybody expected," said Andy Flower, a U.K.-based consultant to the LNG industry and a former BP Plc executive. He forecasts that the world LNG shortage will last until at least 2011.

Gas may become more important than oil in the next 50 years because crude supplies are running out faster, according to the Paris-based IEA. Global oil and natural gas reserves were about the same at the end of 2005, equal to 1.2 trillion barrels of crude, according to data compiled by BP. Oil reserves are being burned almost twice as quickly as gas.

LNG sales rose about 11 percent last year to 157 million metric tons, according to Wood Mackenzie Consultants Inc. in Edinburgh. It may jump about 66 percent to 261 million tons in 2010 and another 87 percent to 488 million by 2020, the group said.

Record LNG prices won't fall for "years to come," said Ari Soemarno, president of Indonesia's state energy company, PT Pertamina, until 2005 the world's largest LNG exporter. Prices under multiyear contracts, excluding freight and insurance, range as high as about $10 per million British thermal units in Asia, assuming $60 a barrel for oil, part of LNG price formulas.

Natural gas deposited near industrialized nations is typically transported through pipelines. The challenge is getting gas from the biggest producers -- Russia, Qatar and Iran -- to consumers worldwide who aren't linked by those networks. Now, gas that can't be transported is pumped back underground to force more crude to the surface, or burned off.

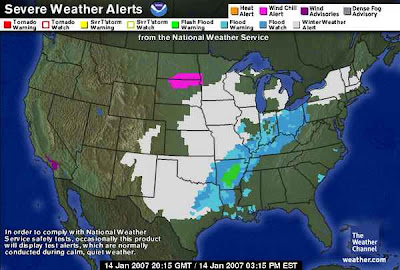

Sunday, January 14, 2007

Cold Brings Increased Natural Gas Usage

A sprawling winter storm system continues to plague much of the nation today with ice, snow and heavy rain.

A sprawling winter storm system continues to plague much of the nation today with ice, snow and heavy rain.Ice storm warnings remain posted from portions of western and northern Texas northeastward to the mid-Mississippi Valley. Over the next 12 hours, the most significant icing--up to a quarter of an inch or so--seems likely from north-central and parts of northeastern Texas into eastern Oklahoma. But that's not to say that other areas under ice storm warnings won't experience problems. Even freezing drizzle can be extremely dangerous on roads.

Friday, January 12, 2007

Freezing rain hit Oklahoma on Friday at the start of what forecasters say could be a brutal ice storm.

Freezing rain hit Oklahoma on Friday at the start of what forecasters say could be a brutal ice storm.Millions of people in the Texas Panhandle, Oklahoma and eastern Missouri are being warned that conditions will deteriorate Friday afternoon and the storm could spread as far east as Ohio and New York over the Martin Luther King Jr. holiday weekend.

"This is a one-in-maybe-15-to 25-year event," CNN severe weather expert Chad Myers said Friday of the forecast freezing rain, sleet and snow.Freezing rain was also forecast for southeast Kansas into central Missouri Friday and is expected to hit I-44 by late Friday afternoon, the National Weather Service said.

Ice up to three-quarters of an inch will be likely by Saturday morning, and some parts could see ice accumulations of an inch and a half by Sunday, all of which could mean widespread power outages, the weather service said.

Temperatures in the week ahead will have highs in the 20s and lows in the teens and possibly single digits, the weather service added, according to AP.

In addition to the central U.S., a cold snap also was predicted this weekend for California, where farmers were preparing to monitor the health of a nearly $1 billion citrus crop, The Associated Press reported.Crude oil for February delivery rose as much as $1.06, or 2 percent, to $52.94 a barrel in after-hours electronic trading on the New York Mercantile Exchange, its first gain this week. The contract traded at $52.34 at 12:58 p.m. in London.

Brent crude oil for February settlement climbed as much as $1.24, or 2.4 percent, to $52.94 a barrel in electronic trading on the ICE Futures exchange and traded at $52.36 in London.

Some analysts and brokers expect a forecast for colder weather next week to push prices higher. Colder weather will reach the northeastern U.S. Jan. 17 through Jan. 21, according to the U.S. National Weather Service. Temperatures in the region were milder than normal through the first part of winter. New York had its third-warmest December on record.

``The temperature is expected to drop below normal after'' the next five days, said Michael Davies, an analyst in London with broker Sucden (U.K.) Ltd. ``Many traders are expecting OPEC to take action in order to support prices.''

Thursday, January 11, 2007

Wednesday, January 10, 2007

The company said U.S. liquids and natural gas production fell almost 1 percent from the third quarter as planned project activity in the Gulf of Mexico continued into December.

Combined international liquids and natural gas production volumes were down 3.4 percent from the previous quarter.

Chevron said production volumes reflect the impact of a change in its service agreement with Venezuela's state oil company, which is estimated to reduce volumes by about 90,000 barrels per day.

U.S. crude realizations decreased by $11.72 per barrel, in line with the decrease in the price of West Texas Intermediate crude and California heavy crude, while international liquids realizations fell $11.05 per barrel, in line with the decrease in Brent spot prices.

Chevron said. U.S. natural gas realizations fell by 51 cents per thousand cubic feet.

Chevron said it expects fourth-quarter results to be at or above the high end of its standard forecast for net after-tax charges for corporate and other activities of between $160 million and $200 million.

Tuesday, January 09, 2007

Temperatures in New York will rise to 48 degrees Fahrenheit (9 Celsius) today, 10 degrees above the normal high, the National Weather Service said. The city had its third-warmest December on record. OPEC will speed up a 500,000 barrel-a-day output cut by almost a month to stop the fall in oil prices, Qatar's oil minister said.

``It's hard to be worried about heating-oil supplies when we've seen 60-degree weather this January,'' said Rick Mueller, an analyst with Energy Security Analysis Inc. ``Refiners are shifting to gasoline production, which should leave us with ample supplies when demand picks up. Demand for crude oil should fall as the product stockpiles grow.''

Crude oil for February delivery fell $1.37, or 2.4 percent, to $54.72 a barrel at 10:21 a.m. on the New York Mercantile Exchange. Futures touched $53.88, the lowest since June 13, 2005, prior to Hurricane Katrina, which destroyed oil platforms and refineries along the U.S. Gulf of Mexico coast. Prices are down 10 percent this year and 14 percent from a year ago.

Monday, January 08, 2007

Up to six inches of snow may fall today in parts of the U.S. Northeast, where four-fifths of the country's heating oil is burned, according to forecasting service Accuweather.com. Russian crude oil deliveries to Poland and Germany along a million barrel- a-day pipeline were halted following a dispute between Russia and Belarus, according to the Polish pipeline operator.

``The weather is the main driver of the market now,'' said Gerrit Zambo, an oil trader at BayernLB in Munich. ``Even small signs of cooler temperatures can bring prices back up toward the $60 a barrel region.''

Crude oil for February delivery rose as much as $1.41, or 2.5 percent, to $57.72 a barrel on the New York Mercantile Exchange and traded at $57.46 at 2:41 p.m. London time. Brent crude oil gained $1.35 to $56.99 a barrel on the London-based ICE Futures exchange.

Polish pipeline operator PERN Przyjazn SA and Grupa Lotos SA, Poland's second-largest refiner, said supplies via the Druzhba pipeline that transports Russian crude through Belarus were cut off last night. The Polish segment of the pipeline carries about 50 million tons of oil a year, including 27 million tons to German refiners.

U.S. Weather

Temperatures may drop below normal in the western U.S. this week and cooler weather will spread across most of the country until Jan. 20, according to the National Weather Service.

New York-traded crude rose 72 cents, or 1.3 percent, to $56.31 a barrel on Jan. 5 after dropping almost 9 percent the previous two sessions. Prices fell last week amid mild weather in the U.S. Northeast and after U.S. fuel inventories climbed more than expected.

Last week's price decline was the biggest since April 2005. The price of oil has plunged about 27 percent from the record $78.40 a barrel reached July 14 after Israeli forces invaded Lebanon to fight Hezbollah militants.

``The next move is likely to be back up again,'' said Adam Sieminski, chief energy economist at Deutsche Bank AG in New York. ``There could be rising hysteria in OPEC because a number of the countries like Iran and Venezuela have been spending like oil was going to stay at $70 a barrel.''

The Organization of Petroleum Exporting Countries agreed to cut output by 1.2 million barrels a day in November, citing slower-than-forecast demand growth and rising global stockpiles. Members agreed in December to cut another 500,000 barrels a day starting Feb. 1.

Friday, January 05, 2007

Wednesday, January 03, 2007

Light, sweet crude for February delivery on the New York Mercantile Exchange fell to $58.97 a barrel in midmorning trading, a drop of $2.08 from Friday's settlement price.

The Nymex trading floor was closed Monday for New Year's Day and Tuesday for the memorial service for former U.S. President Gerald Ford, although there was some electronic trading.

The Brent crude contract for February delivery fell $1.58 to $60.05 a barrel on the ICE Futures exchange, which was open on Tuesday.

In New York City, temperatures on the first day of 2007 hit a peak of 54 degrees Fahrenheit _ much warmer than normal.

But many analysts expect crude oil futures to stay on average above $60 a barrel this year because of robust demand growth in Asia and the Middle East, efforts by the Organization of Petroleum Exporting Countries to trim supply and market-rattling instability in suppliers such as Nigeria and Iraq.

OPEC's concerns that high global stockpiles and sluggish demand would undermine prices led it to agree on a 1.2 million barrel-a-day crude oil output cut in November and a further 500,000 barrel-a-day cut to take place Feb. 1.

"For 2007, oil pricing is likely going to be stubbornly high, with the OPEC group looking like it will want to defend a $55 floor under prices," said Victor Shum, an analyst with Purvin & Gertz in Singapore. He projected crude futures would trade in the $60-65 a barrel range. "With ongoing geopolitical concerns such as Iran and Nigeria, the market will also tend to have buyers on the high side."

Slower economic growth in the U.S. and a production spurt from non-OPEC countries should keep prices below the 2006 average of roughly $66 a barrel, analysts say.

A survey of energy analysts showed U.S. crude oil stocks were expected to decline for a fifth straight week in data due Thursday from the U.S. Energy Information Administration. The data, which will cover the week ended Dec. 22, have been delayed until Thursday because of the three-day Christmas holiday.

Crude stocks were expected to show a draw of 1.32 million barrels on average, a Dow Jones Newswires survey said, while both distillate and gasoline stocks were predicted to rise.

Distillate stocks, which include heating oil and diesel fuel, are expected to increase by an average of 220,000 barrels while gasoline inventories were seen rising by an average of 590,000 barrels.

Heating oil futures fell 4.72 cents to $1.6010 a gallon, while natural gas prices dropped 11.2 to $6.187 a gallon.